CreditHOPE helps you understand your credit health and unlock your full credit potential

Which one are you?

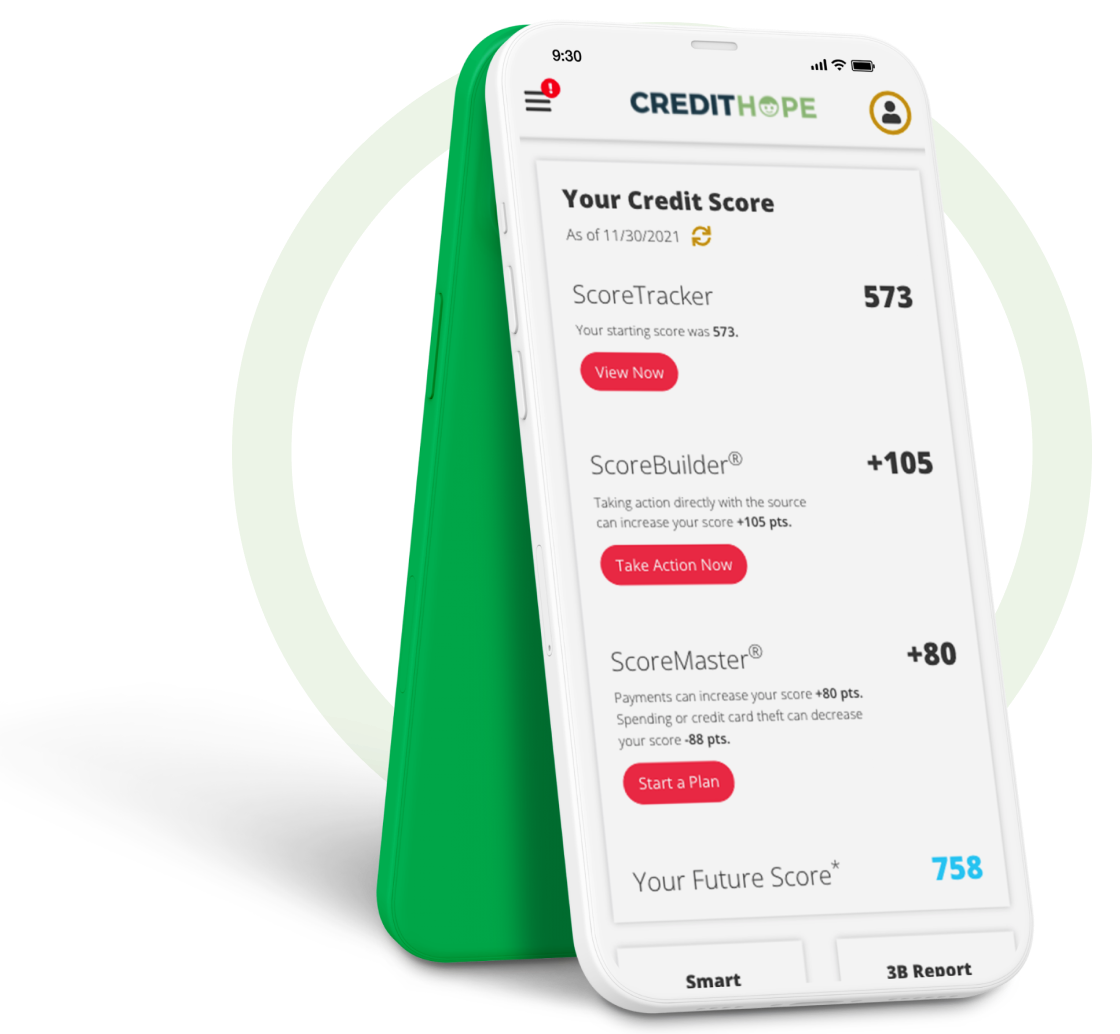

ScoreTracker

It is now easier than ever to track all your scores with simple charts or in-depth information.

ScoreBuilder®

See exactly what is helping or hurting your credit score. Get your 120-Day Plan to a better score.

ScoreBoost™

Be the master of your credit score! Use ScoreBoost™ before you apply for credit, make payments or spend money.

Plus, Your Money, Credit & Insurance

Money Manager

All your online banking in one place. Use action buttons to quickly ask questions and resolve problems.

Alerts and Insurance

Your mobile or email Alerts have action buttons to quickly ask questions and resolve problems.

Plus, you get $1 million identity fraud insurance for your whole family.

– Activation is required

CreditHOPE Report®

A simple and innovative way to view your credit report. Use action buttons to quickly ask questions and resolve problems.

Membership Snapshot

- CreditHOPE Report & Scores

- ScoreTracker

- ScoreBuilder®

- ScoreBoost™

- Actions

- Credit Monitoring

- Money Manager

- 3B Report & Scores

- $1MM ID Fraud Insurance

Protect

$24.95/mo

Build

$59.95/mo

Get your 3B Credit scores and Reports with monitoring

Our Action Buttons Connect You

What people are saying…

Tess M.

“I use the action button almost every day for my money and credit report. Thank you for a simple tool!”

Michael N.

“Thank you, it is very easy to use. I clicked on the action button to change my address without having to call or write them.”

Sarah W.

“I love being able to work on my credit score with ScoreBuilder.”

Hot Topics Our Members Are Interested In

With the increased risk of identity theft and credit fraud, it’s more important than ever to know what’s happening with your credit at all times. While reviewing your full credit report throughout the year is a great way to stay on top of your credit, your financial information needs all the protection you can give it.

With a credit monitoring service you can trust, not only will you be able to receive your credit reports and scores easily, you will also be notified if any suspicious or unauthorized activity occurs on your credit report.

With CreditHOPE, our goal is to provide you with a simple platform for your money and credit all in one place, and with innovative tools to help you rest assured that your credit accounts are being monitored 24/7.

With tools such as ScoreTracker, ScoreBuilder®, and ScoreBoost™, you can now track your credit scores easier than ever before and see what is helping or hurting your credit score. Also, use our, Action buttons to easily communicate directly with your creditors, and be on your way to becoming the master of your future credit score.

Take a look at some of the innovative credit monitoring tools we offer.

Credit Monitoring & 3-Bureau Credit Reports & Scores

Your credit score is one of the most valuable financial tools you have in life. With CreditHOPE’s credit monitoring services, you can insure yourself against identity theft and track not only your credit reports, but your daily credit and financial transactions as well.

Your credit report is like a report card of your entire financial history. With CreditHOPE, you can quickly receive your three bureau credit reports and scores in an easy-to-read format and review it regularly for accuracy to start becoming the master of your credit score today!

Identity Fraud Insurance

Dispute Errors on Your Credit Reports

Check Your Credit Score

Your credit score plays a vital role in credit decisions and can open the door to many opportunities. Enroll with CreditHOPE today and not only are you provided with the different types of credit scores that exist, but also credit score tools that allow you to take more control of your credit score.

Sign up with CreditHOPE to get your credit report and to start controlling your future credit score today!

Do Reports Show Credit Scores?

Your credit report contains several pieces of crucial information, such as your credit history, the different types of credit you have previously used, and for how long, any outstanding debts you may have, and how frequently you made payments on the agreed-upon due dates every month.

The data within your credit report is used by various lenders and creditors to determine your financial responsibility, and whether or not you are a risk in terms of extending credit.

Credit reports contain data from four main categories of personal and financial information.

Personally Identifiable Information (PII): Refers to personal information that can be used to identify you, such as your full name, current and previous address, date of birth, and social security number.

Credit Accounts: Each credit account you have opened with various creditors and lenders.

Credit Inquiries: Inquiries are a record of who has accessed your credit report and on what date. Hard inquiries are made each time you apply for a new line of credit, while soft inquiries are made each time you view your credit report.

Public Record and Collections: Refers to personal information such as bankruptcies, debt collections, and any pending legal issues.

However, credit scores are not shown on your credit report because they represent a different insight into your credit. Credit reports indicate your credit activity, while credit scores reflect a calculation of your credit activity.

What is Considered a Good Credit Score?

Credit scores are used by financial companies to help them determine if a consumer has any potential risk in extending them credit. Most often, credit scores are used by financial institutions, credit card companies, and car dealerships to determine whether or not they should provide you with credit, and what the terms, interest rate, and down payment of the credit will be.

Credit score calculations are placed into five categories between the ranges of 300-850:

- Poor: 579 or below

- Fair: 580-669

- Good: 670-739

- Very Good: 740-799

- Excellent: 800 or above

Generally, credit scores above 670 are considered good, and a credit score above 800 is considered to be an excellent credit score. Most consumers fall somewhere between 600 to 750.

As mentioned, the benefit of having higher credit scores represent more financial responsibility, thus providing creditors and lenders with more confidence that you will be able to repay any future debts as agreed upon. Get a credit report today and see where your credit score stands.

How Do I Get All Three Credit Reports and Scores?

Do All Three Credit Reports Have the Same Information?

The credit reporting agencies are responsible for maintaining your credit report and providing the data to various creditors and lenders who request it. There are three major credit reporting agencies.

- Equifax

- TransUnion

- Experian

However, information that is provided to each of the three credit bureaus may be different due to the individual creditors furnishing your data. For example, one credit bureau may have more or fewer inquiries than the other two, which could potentially produce different looking credit reports.

Because of this, it’s recommended that you request your credit report with each of the three major bureaus so that you have a comprehensive look into your financial standing, and quickly identify any difference that could potentially be affecting it.

Monitoring your credit is tough to do on your own. Your CreditHOPE membership provides you with the absolute best platform for your money, credit, and identity all in one.

Sign up to find out how you can start controlling our future credit score today!